Barcelona, February 6, 2017.- Grifols (MCE: GRF, MCE: GRF.P and NASDAQ: GRFS), a global healthcare company with a track record of more than 75 years improving people's health and well-being and a leader in the production of plasma medicines, transfusion diagnostic systems and pharmaceutic specialties for hospital use, has concluded its debt refinancing process started on January 9, 2017, optimizing its debt structure, improving financing conditions in all tranches and extending maturities.

The refinancing process has been conducted in record time given the favorable acceptance that it has in the international capital markets and among investors and financial institutions, which understand and positively value the company's management and its growth policy, both organic and through strategic acquisitions. In this regard, 50 financial institutions have subscribed tranche A and 140 institutional investors tranche B.

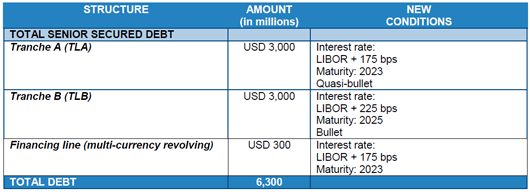

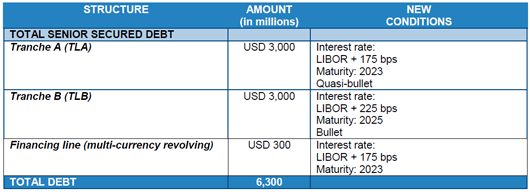

The total amount of debt subject to this process is USD 6.3 billion (EUR 5.8 billion), including the long-term syndicated financing with financial institutions and institutional investors segmented into 2 tranches (Tranche A and Tranche B), the undrawn multi-currency revolving credit facility and the USD 1.7 billion of the term loan to finance part of the purchase of the Hologic's transfusion diagnostics business. The placement of USD 6.3 billion of senior secured debt was significantly over-subscribed, making it possible to improve the cost of the two tranches.

The average cost of the refinanced debt is 2.65%. The margin has been reduced by 100 bps and is at 200 bps, significantly improving the current conditions.

The refinancing has not included the USD 1 billion bond issue.

Financial structure of Grifols and the new conditions subsequent to the conclusion of the refinancing process:

Grifols is committed to rapidly reducing its leverage levels. The company plans to absorb the debt increase through a greater capability to generate cash flows. Historically, Grifols has a track record of deleveraging ability post acquisitions.

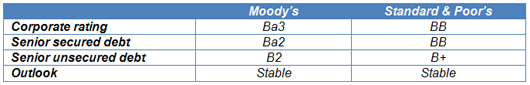

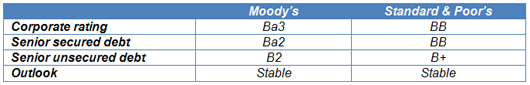

Subsequent to the acquisition of part of Hologic's transfusion business, its credit ratings from Standard & Poor's have remained unchanged. Moody´s revised its credit ratings by one notch, while it maintains a "stable" outlook for the company.

The conclusion of the refinancing process has not entailed any variations and both ratings agencies have affirmed their credit ratings.

The current credit ratings are as follows:

Advisors

Osborne Clarke, S.L.P. and Proskauer Rose, LLP have acted as legal advisors in the refinancing process, while Nomura, HSBC, Bank of America Merrill Lynch and Goldman Sachs were the bookrunners.