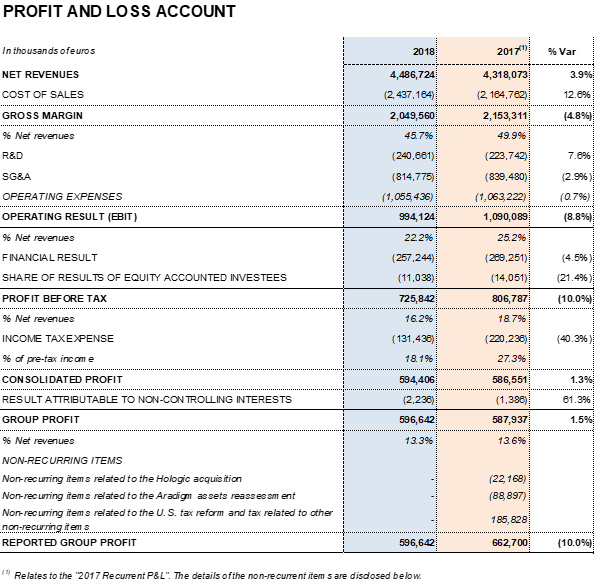

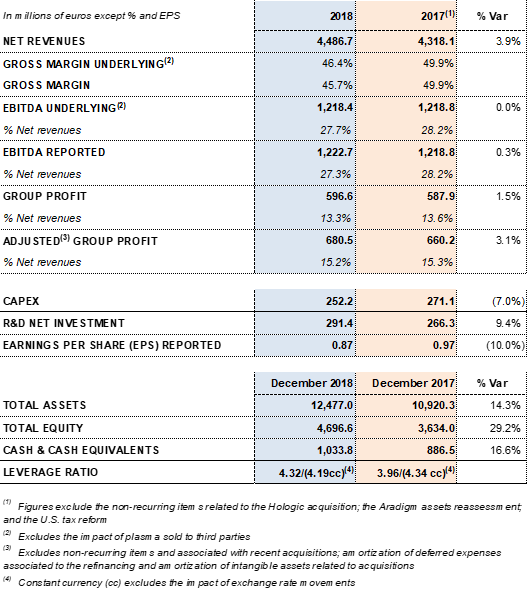

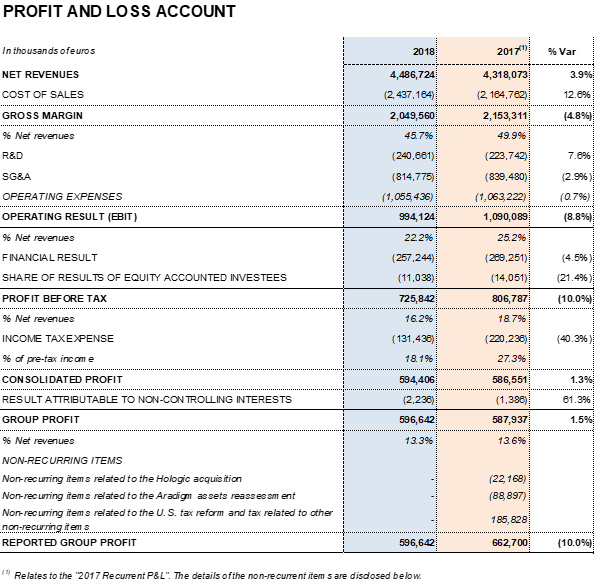

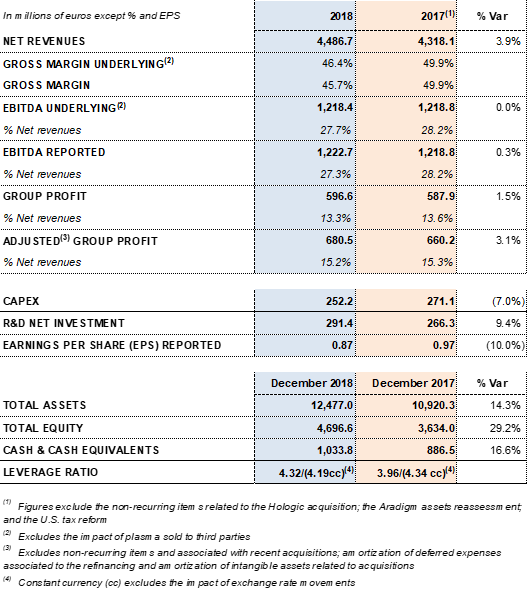

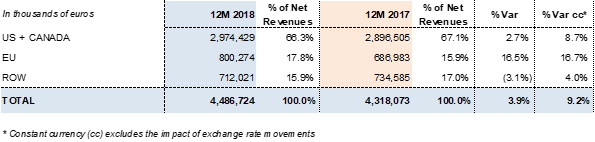

Barcelona (Spain), February 28, 2019.- Grifols (MCE:GRF, MCE:GRF.P, NASDAQ:GRFS) recorded EUR 4,486.7 million in revenues in FY 2018, with 9.2% cc2 year-on-year growth (3.9% taking into account exchange rate variations). The company reported growth in all divisions and geographic regions where it operates.

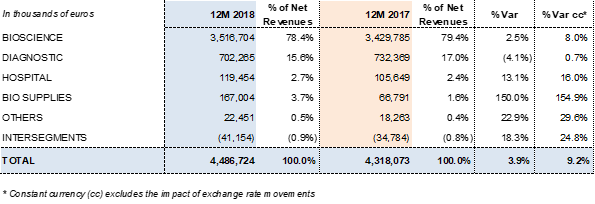

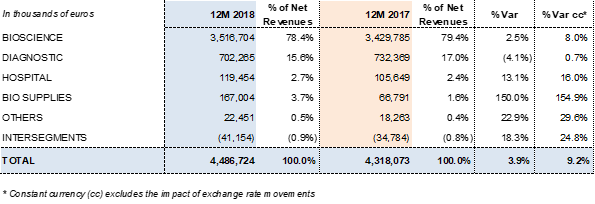

The Bioscience Division led Grifols' growth. The division's revenues grew to EUR 3,516.7 million, with operational growth of 8.0% cc (2.5% considering exchange rate variations). Continued higher demand for its main plasma-derived products was the driving force behind this upswing. Of note were higher sales and price points of immunoglobulin in some markets. The sales upswing of these plasma proteins, together with certain specialty immunoglobulins, offset the drop in factor VIII sales. The renewal processes of certain licenses in China suffered delays in the last quarter of 2018, impacting sales.

Diagnostic Division revenues remained stable, growing by 0.7% cc (-4.1% considering exchange rate variations) to EUR 702,3 million. Grifols is a global leader in transfusion medicine, the division's main growth driver.

The Hospital Division reported EUR 119.5 million in sales in 2018, growing by 16.0% cc and 13.1% taking exchange rate variations into account. The division continued to note strong sales in all of its business lines. It leads the Spanish market in IV solutions. The division continues to offer a broad portfolio of hospital pharmacy solutions in Spain and Latin America, while expanding its business in the U.S.

The Bio Supplies Division includes three main areas: sales of biological products for non-therapeutic uses, Kedrion manufacturing agreements, and third-party plasma sales from Haema and Biotest, which totaled EUR 80.3 million. Bio Supplies earned EUR 167.0 million in revenues in 2018, a substantial increase from the EUR 66.8 million reported in 2017.

Underlying EBITDA1 increased to EUR 1,218.4 million, representing a 27.7% margin. Gross margin continues impacted by higher plasma costs as a result of Grifols' efforts, both organic and inorganic, to increase access to its main raw material and fulfill the continued demand for its plasma-derived therapies.

Grifols operates 256 centers in the U.S. and Europe, the largest plasma collection network in the world. This network includes the acquisition of six Kedplasma centers; 24 Biotest US centers in the U.S.; 35 Haema centers in Germany; and a newly inaugurated center, also in Germany, as part of its joint venture with Plasmavita Healthcare.

The last quarter of the year saw a significantly higher demand for immunoglobulin, especially in the United States, where Grifols works on the launch of 20% subcutaneous immunoglobulin that will expand Grifols' IG franchise. This upturn has affected the utilization of liters of plasma. Gross margin was also impacted by temporary albumin sales restriction in China; geographic mix of factor VIII sales, tender volatility; and the product mix of the Diagnostic Division, which reported stronger demand for antigens used to produce immunoassays and transfusion-medicine diagnostic instruments.

In terms of operating expenses, Grifols decided to increase its R+D+i investment in certain projects, specifically those related to albumin, in light of the positive results of the AMBAR trial and trials on liver diseases (PRECIOSA and APACHE studies). Corporate operations, including Haema and Biotest acquisitions, as well as the negotiations with Shanghai RAAS, caused related operating expenses to rise.

Grifols' annual financial results totaled EUR 257.2 million. This figure includes an influx of EUR 32.0 million following the expected divestment in Tigenix, carried out in the second quarter of 2018.

The effective tax rate was 18.1%, as a result of the U.S. tax reform, approved in December 2017.

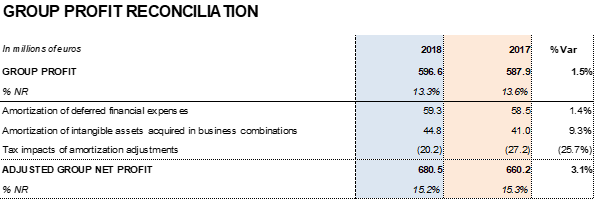

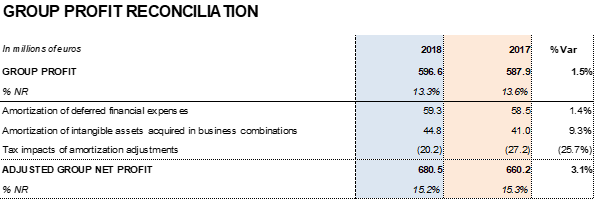

Excluding non-recurrent expenses3 recognized at the end of 2017, Grifols' net profit increased by 1.5% to EUR 596.6 million, compared to EUR 587.9 million in 2017. It represents 13.3% of revenues.

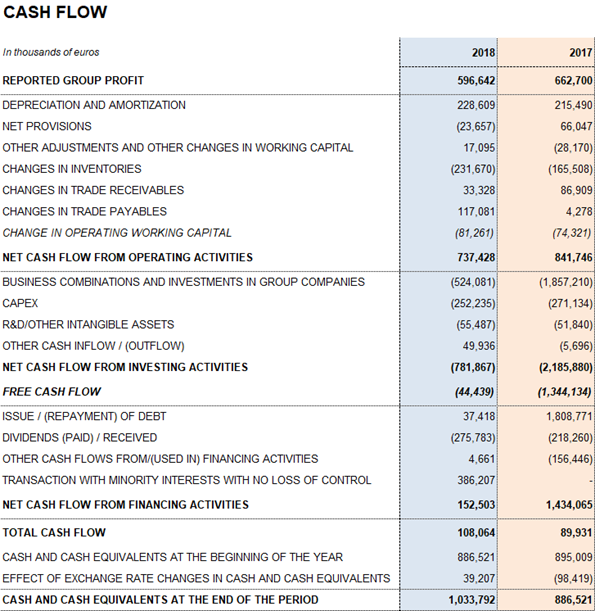

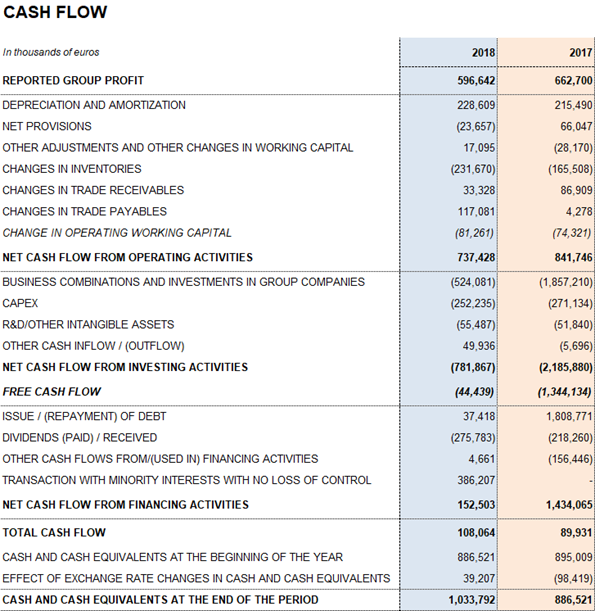

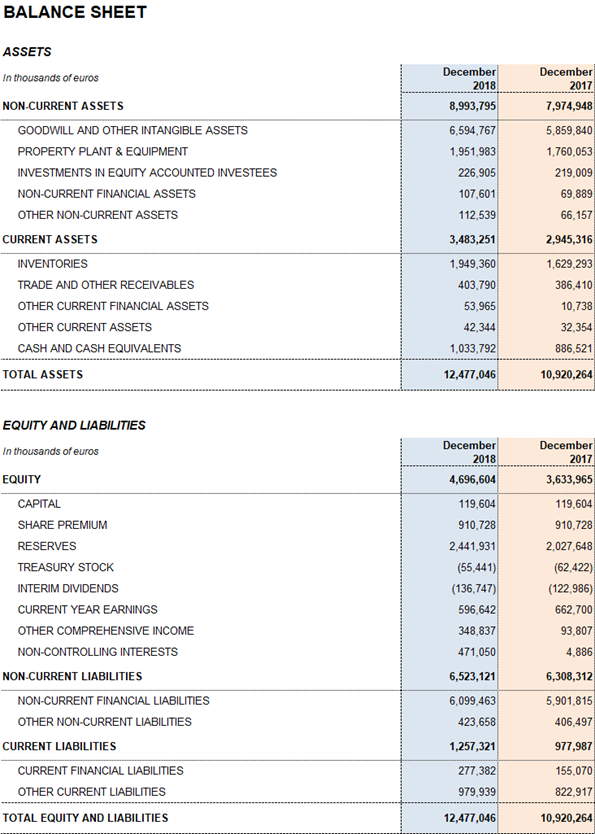

Grifols' net financial debt was EUR 5,343.1 million, including EUR 1,033.8 million in cash (EUR 886,5 million in 2017). The company has nearly EUR 400 million in undrawn lines of credit, which increase its liquidity position to nearly EUR 1,400 million.

The group's net financial debt over EBITDA ratio was 4.32x as of December 2018. This figure drops to 4.19x excluding the impact of exchange rate variations.

Leverage management remains among the company's top priorities. To this end, Grifols maintains high, sustainable levels of operational activities and strong net operating cash flow generation. The EUR 737.4 million cash flow from operating activities allows the firm to effectively undertake its planned investments in the current context of growth.

Grifols allocated EUR 252.2 million in 2018 (EUR 271.1 in 2017) toward CAPEX and EUR 291.4 million (EUR 266.3 million in 2017) of net investments toward R+D+i. The company remains firmly committed to future growth and its long-term strategic vision.

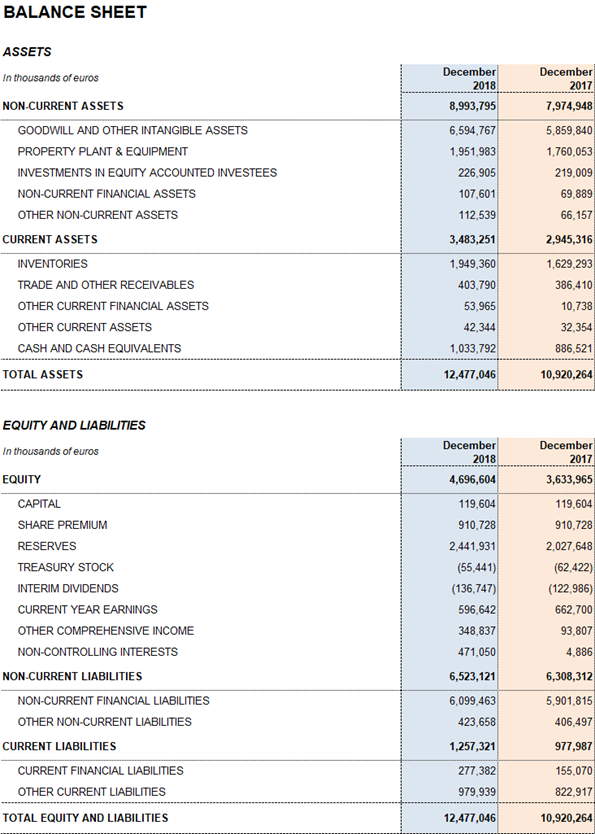

Grifols' solid performance and positive cash flow trend helped reinforce the balance sheet. As of December 2018 consolidated assets totaled EUR 12,477.0 million (EUR 10,920.3 million in 2017). This upturn was fueled primarily by the Bioscience Division, which grew both organically and via corporate transactions, as well as by capital investments.

At the close of 2018, Grifols agreed to sell Haema AG and Biotest US Corporation to Scranton Enterprises, B.V. for USD 538 million in order to monetize earlier these investments and reinforce its financial structure. Grifols maintains operational control of the plasma centers and holds an exclusive and irrevocable call option for both companies.

Optimizing working capital remained a priority to strengthen the company's financial position. Inventory levels increased to EUR 1,949.4 million, with a turnover of 292 days compared to 275 days in December 2017 following the roll-out of initiatives to anticipate and meet the solid demand of plasma-derived products.

The days sales outstanding improved to 22 days (24 days in 2017), reflecting the optimization measures. The average payment period is 65 days, a slight increase from the 53-day period reported in 2017.

The company's equity as of December 31, 2018 was EUR 4,696.6 million. The share capital includes 426,129,798 common shares (Class A), with a nominal value of EUR 0.25 per share, and 261,425,110 non-voting shares (Class B), with a nominal value of EUR 0.05 per share.

Two dividend payments totaling EUR 278.8 million were distributed in 2018. In the second quarter of 2018, a second dividend, charged against 2017 earnings, was paid out as a final dividend, and an interim dividend was paid in December 2018. Grifols remains committed to compensating its shareholders with dividend payouts.

Key financial metrics 2018:

PERFORMANCE OF GRIFOLS DIVISIONS: LEADERSHIP OF KEY DIVISIONS

Bioscience drives growth: EUR 3,517 million in revenues and 8.0% cc growth

The division grew by 8.0% cc in 2018 (2.5% taking the exchange rate fluctuations into account), to EUR 3,516.7 million. Robust sales of the main plasma proteins – immunoglobulin, albumin and alpha-1 antitrypsin – were the main drivers of revenue growth throughout the year. Of note were higher sales and price points of immunoglobulin in some markets. The sales upswing of these plasma proteins, together with certain specialty immunoglobulins, offset the drop in factor VIII sales. The renewal processes of certain licenses in China suffered delays in the last quarter of 2018, impacting sales.

The demand for immunoglobulin remains strong in Grifols' core markets, especially in the U.S. and main EU countries, led by Spain, Germany and the United Kingdom. Sales also grew in Turkey, Brazil and Australia, where, in addition to primary immunodeficiencies (PID), immunoglobulins are used to treat secondary immunodeficiencies (SID) and neurological diseases like chronic inflammatory demyelinating polyneuropathy (CIPD), a market segment that Grifols leads.

Immunoglobulin sales achieved double-digit growth in 2018. Amid this context of market growth, Grifols plans to launch a 20% subcutaneous immunoglobulin in the second half of 2019.

Albumin sales grew considerably in the U.S. and several European countries including Italy, the United Kingdom and Turkey. China remains a strategic market for Grifols, with significant underlying demand.

Grifols continues as the market leader in alpha-1 antitrypsin sales. Market penetration of this plasma protein grew in the U.S. and main EU markets thanks to commercial efforts and growth in the number of diagnosed patients.

Also of note is Grifols' FDA-approved genetic test for alpha-1 deficiency and Prolastin®-C Liquid, recently introduced in the U.S. This liquid formulation enhances Grifols' respiratory franchise, in addition of offering patients another treatment option.

Sales of factor VIII sales fell notably in 2018 as a result of their declining use to treat patients with inhibitors. The company positions factor VIII as the optimal treatment for Hemophilia A patients, focusing its efforts in the U.S. and emerging markets.

Grifols continues to promote its specialty proteins to enhance its differential product portfolio. Two new formulations helped boost sales in the specialty hyperimmunoglobulins segment: an anti-rabies immunoglobulin (HyperRAB®), with a twice the potency (300 IU/mL) of currently available rabies immune globulin options; and GamaSTAN®, an intramuscular immunoglobulin for patients exposed to hepatitis A or measles. Both products earned FDA approval in the first half of 2018.

Diagnostic Division remains stable: 0.7% growth cc leads to EUR 702 million in revenues

The Diagnostic Division reported EUR 702.3 million in revenues, a 0.7% cc year-on-year increase and -4.1% taking exchange rate variations. Grifols is the global leader in transfusional diagnostics, the division's main engine for growth in 2018. This business area includes NAT donor-screening diagnostics (Procleix® NAT Solutions), blood-typing solutions and the production of antigens for immunoassays.

Higher NAT solutions sales were primarily fueled by an increase in plasma donations and the growing use of the Zika-virus screening test (Procleix® Zika Virus). The company's product portfolio also incorporated newly FDA-approved reagents to detect HIV, hepatitis B and C virus (Procleix® Ultrio Elite), and the West Nile virus (Procleix® WNV), among others.

In addition to the U.S., Latin America, Poland and Indonesia also reported strong sales for this leading-edge technology. The company continues its efforts to build its presence in the Middle East.

The blood-typing line notably contributed to the division's overall performance, particularly in the U.S., core markets in Latin America, Europe, and Saudi Arabia.

European sales of Erytra Eflexis® gained traction, with more than 200 units sold since its June 2017 launch. Grifols already introduced the product in the U.S. in 2019 after obtaining FDA approval. Also of note in 2018 was the release of a new line of conventional antiserums, which broadened the product portfolio following its FDA approval.

The company continued to consolidate its line of antigens to produce immunoassays in 2018.

Revenues in specialty diagnostics remained stable and are expected to rise as Grifols widens its clinical diagnostics offerings. In 2018, the FDA approved two diagnostic products designed to detect autoimmune diseases. Both were developed by AESKU and distributed by Grifols on the Helios platform.

The company is committed to developing new diagnostic tests for personalized medicine through Progenika Biopharma. Its molecular diagnostic ID CORE XT for genotyping blood groups earned FDA approval.

Hospital grows 16% cc to EUR 120 million in revenues, fueled by strong U.S. sales

The Hospital Division earned EUR 119.5 million in revenues in 2018, growing 16.0% cc and 13.1% taking into account exchange rate variations.

Sales of all business lines grew in 2018, especially the Pharmatech line in the U.S. market. A key strategic area for future growth, this business line offers integral services to hospital pharmacies for IV compounding, including MedKeeper and Kiro Oncology products.

The division also reported higher IV solutions sales, especially the physiological saline solution manufactured in the Murcia (Spain) plant. After obtaining FDA approval, Grifols was able to introduce the product in the U.S. market, including its own network of plasma donation centers. These milestones enabled the division to enhance its presence in the United States and promote the group's global expansion strategy.

Sales of the Nutrition and Medical Devices lines also increased, accompanied by a surge in third-party manufacturing services.

Bio Supplies Division: Kedrion manufacturing agreement and third-party plasma sales drive growth

This division oversees three main areas: sales of biological products for non-therapeutic uses, Kedrion production agreements, and third-party plasma sales channeled through Haema and Biotest, which represent EUR 80.3 million. Bio Supplies earned EUR 167.0 million in revenues in 2018, a substantial increase from the EUR 66.8 million reported in 2017.

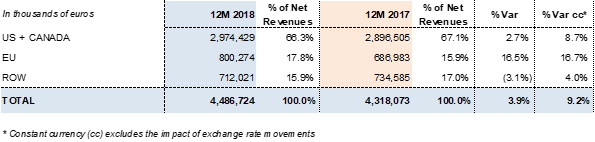

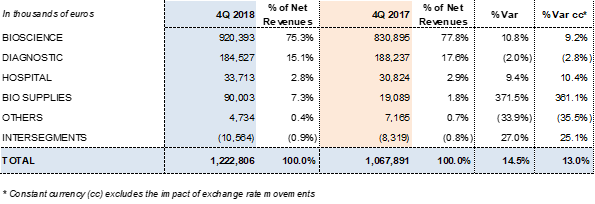

Revenues by division:

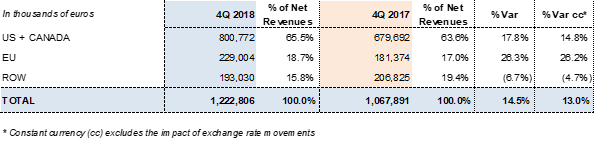

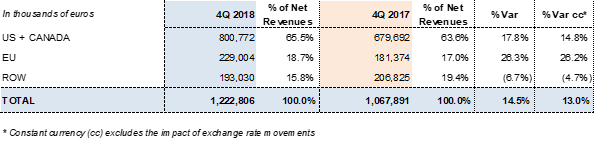

Revenues by region:

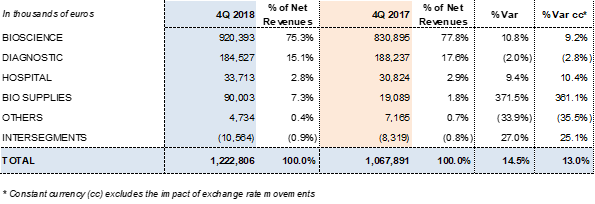

FOURTH QUARTER 2018

Bioscience Division drives operating revenue growth of 13%

Grifols reported EUR 1,222.8 million in revenues and a 13% increase in operating growth (14.5% taking exchange rate variations into consideration).

The Bioscience Division served as the primary engine for growth, with EUR 920.4 million in revenues and a 9.2% cc increase in sales (10.8% with exchange rate fluctuations). Robust demand for immunoglobulins continues in the U.S. and some EU markets, and alpha-1 antitrypsin sales remain strong in core markets. Meanwhile, the group noted a delay in albumin sales in China due to the renewal process of certain product licenses.

The Diagnostic Division earned EUR 184.5 million in revenues (-2.8% cc and -2.0%). The Hospital Division built on its upward trend thanks to a solid global expansion strategy, reporting 10.4% cc growth (9.4%) and EUR 33.7 million in revenues. For its part, the Bio Supplies generated EUR 90 million in revenues, due mainly to third-party plasma sales linked to the Haema and Biotest acquisitions.

Revenues by division:

Revenues by region:

INVESTMENT ACTIVITIES: R+D+i, CAPEX AND ACQUISITIONS

R+D+i: Strategic focus and resources allocated

Grifols advocates an integrated R+D+i strategy that comprises both in-house initiatives and external projects in investee companies whose research complements its core business. This dual approach and long-term vision earned Grifols the distinction as one of the top 1,000 global firms that dedicate the most resources to R+D in "2018 Global Innovation 1000" by Strategy&, the consulting arm of PwC.

Grifols intensified its net R+D+i investments in 2018 by 9.4% to EUR 291.4 million, taking into account net investments for both internal and external research initiatives. This investment represents 6.5% of 2018 revenues.

Main research lines and projects in 2018 include:

Preliminary results on AMBAR's effectiveness: Grifols presented top-line results of the phase IIb/III of its AMBAR (Alzheimer Management By Albumin Replacement) clinical trial at the annual Clinical Trials on Alzheimer's Disease (CTAD) Congress, held in October 2018.

AMBAR is an international, multicenter and double-blind clinical trial designed to evaluate the efficacy and safety of plasma exchange – a procedure that combines periodic extractions of plasma through plasmapheresis and its replacement with albumin – in order to slow down the progression of Alzheimer's disease (AD) in patients in mild to moderate stages.

The trial results demonstrated a statistically significant 61% slowdown in the progression of the disease among patients with moderate AD and fulfillment of its primary endpoints: improvements in cognitive function (measured on the ADAS Cog scale) and ability to carry out daily activities (measured on the ADCS-ADL scale).

These results mark an important milestone in Alzheimer's research and motivate the company to continue its research to confirm the benefits of plasma exchange with Grifols albumin to slow down the progression of AD.

Ebola Project: In 2014, Grifols launched a non-profit initiative to produce anti-Ebola immunoglobulin to treat afflicted populations in West African countries. The project's research line forms part of a long-term clinical trial aimed at evaluating whether plasma from healthy Ebola survivors can boost the immune response in afflicted patients and help them overcome the disease.

Grifols began processing the first batch of plasma from Ebola survivors at the end of 2018 and anticipates delivering the first anti-Ebola immunoglobulins to the Republic of Liberia in the first quarter of 2019.

Within the Bioscience Division, Grifols successfully completed the clinical research phase of a new 20% subcutaneous immunoglobulin to treat patients with primary immunodeficiencies. The product has been submitted to the FDA for commercial authorization.

The company also developed a new predictive model for population pharmacokinetics (PopPK) to administer subcutaneous immunoglobulin in patients with primary immunodeficiencies, which would inform the proper dosing of this plasma-derived product and guide its treatment usage.

Grifols continues its research on Gamunex® as maintenance therapy for myasthenia gravis (MG), a chronic autoimmune neuromuscular disease. The company plans to apply for EMA marketing authorization in 2019. Research also progresses on the phase III PRECIOSA study to assess the benefits of albumin to treat liver cirrhosis, as well as the phase III APACHE trial to treat acute-on-chronic liver failure (ACLF). Additionally, the product's new flexible packaging format is currently in the registration stage.

In the Diagnostic Division, Grifols' blood test to detect the babesiosis parasite (Procleix® Babesia) obtained FDA approval subsequent to year-end. Clinical trials also continue in China on the Procleix® Ultrio Elite line, and to expanding its portfolio of recombinant proteins.

The Hospital Division presented two new products for FDA approval: a physiological saline solution in a needle-free Fleboflex® container, which, in addition to enhancing the product portfolio, can be utilized in Kiro-Grifols robotics systems; and an anti-coagulant in a bag format that will benefit Grifols' plasma centers and expand the third-party product portfolio.

CAPEX and manufacturing operations

Grifols invested EUR 252.2 million in 2018 as part of its on-going efforts to expand and enhance its manufacturing facilities. This figure is stipulated in the 2016-2020 Capital Investment Plan, endowed with EUR 1,200 million to ensure the company's long-term sustainable growth.

As outlined in its strategic plan, Grifols continued its investments in 2018 to increase its plasma supply. As of December 2018, Grifols operated the largest plasma donation network in the world, with 256 centers. Thanks to its capital investments, the company increased its average number of daily donations to 39,000 and total volume of plasma obtained for fractionation to nearly 12 million liters. This volume is a 30% increase compared to 2017.

In the Bioscience Division, investments remain focused on boosting the company's capacity to fractionate and purify plasma proteins. Construction on a new plasma fractionation plant at Grifols' North Carolina (USA) complex continues as planned. The facility will have a fractionation capacity of 6 million liters per year, twice the current volume of the site. Construction is also underway on a new purification, dosing and sterile filling plant of immunoglobulin in flexible containers. The facility will have an annual capacity of 6 million equivalent liters of plasma per year.

The industrial complex in Los Angeles (California, USA) obtained FDA approval for a second immunoglobulin (Gamunex®) purification, dosing and sterile filling line. This addition will enable the facility to double its annual production capacity to 5.1 million equivalent liters of plasma per year. Also worth noting is the sterile filling plant of albumin in flexible containers, whose validation process ended in 2018. The plant has an annual production capacity of 1.5 million equivalent liters of plasma per year.

The construction of a new albumin purification, dosing and sterile filling plant in Dublin (Ireland) continues according to schedule. The plant will have a yearly production capacity of 6 million equivalent liters of plasma per year and incorporate state-of-the-art filling technology to boost productivity.

The Barcelona industrial complex completed the validation process of the alpha-1 antitrypsin purification, dosing and sterile filling plant. The site is equipped with Grifols' next-generation filling technology and has an annual production capacity of 4.3 million equivalent liters of plasma per year.

This complex is also in process of adding manufacturing installations to produce fibrin sealant and topical thrombin. The facility will have a production capacity of 1.7 million units per year.

In the Diagnostic Division, the new installations in the Emeryville (California, USA) plant to manufacture recombinant proteins and a recombinant antigen for hepatitis C received FDA approval. The company plans to submit additional FDA applications in 2019 to relocate the production of 21 antigens to its new facilities.

The San Diego (California, USA) installations are currently in the validation stage following a remodeling process to consolidate production of the NAT donor-screening line.

The Brazil plant, dedicated to the manufacture of collection, separation, storage and transfusion bags for blood components, is nearing the end of the validation stage. At present, the installation has a production capacity of 2 million units per year, scalable to 4 million units.

Hospital Division capital investments were dedicated to expanding the capacity and productivity of its intravenous lines at its Barcelona and Murcia complexes to meet the projected growth of this segment.

Acquisitions and corporate transactions

Grifols strengthened its leadership position in global plasma supply following the 100% acquisitions of Haema AG, headquartered in Germany, and Biotest US Corporation.

The Haema acquisition enabled Grifols to operate its first plasma centers outside the U.S. The transaction included 35 centers and three under construction; a 24,000-square-meter building in Leipzig which houses Haema's corporate headquarters; and a central laboratory in Berlin. For its part, the Biotest US Corporation acquisition included 24 U.S.-based plasma centers and two under construction, as well as diverse assets.

Subsequent to these acquisitions, Grifols sold both companies under the same terms and conditions to strengthen its financial structure. The company holds an exclusive and irrevocable call option to be executed at any time for both Haema and Biotest, and maintains operating control of their plasma centers.

Grifols acquired six plasma centers from Kedplasma in 2018.

In line with the Hospital Division's strategic growth plan, Grifols acquired a 51% stake in MedKeeper, a U.S. technology firm that develops and markets mobile and web-based software applications to optimize the efficiency and safety of hospital pharmacies. The agreement includes a call option to acquire the remaining 49% interest within a three-year timeframe.

CORPORATE RESPONSIBILITY

Human Resources: a larger talent pool and wider array of training opportunities

In 2018, Grifols' workforce included 21,230 employees, a 16% increase compared to the previous year. The number of women increased across all professional categories, especially in occupational positions (+37%) to 1,379 women; management (+25%) to 590 women, and top management (+24%) to 172 women.

Grifols talent pool increased in all divisions and regions. In Europe, Grifols has 5,467 employees (+29.7%), including 3,858 in Spain. The company employs 15,330 people in the U.S. (+12.1%) and 433 (+5.6%) in the rest of the world (ROW).

The following figures illustrate the evolution of Grifols' workforce in 2018 and the results of its proactive talent management strategies:

- 59% women and 41% men

- 98.3% permanent contracts overall and 98.7% rate among female employees

- More than 51.7% of employees are between 30 and 50 years old

- 93.8% of employees work full time; 92.4% in the case of women

- 32% of top management are women

Continuous training and professional development opportunities form the pillars of Grifols' human resources efforts. The company promotes talent management and employee retention through equal pay policies, internal promotions, professional development initiatives, and specific technical-scientific training programs, as well as offerings to boost business and managerial competencies.

Grifols strives to continuously train its talent pool with the necessary skills and competencies to successfully perform their jobs and prepare them for roles of greater responsibility in the future. The company established the "Grifols Academy" in 2009 to enhance the skillset and leadership potential of its talent pool and cultivate dynamic forums for learning and knowledge-sharing.

Grifols Academy offers ongoing educational opportunities in Spain and the United States focused along three main lines: professional development, plasmapheresis and immunohematology.

The Grifols Academy partnered with College for America in 2015 to offer Grifols employees the chance to earn university degrees. Also, Grifols partners with several local universities in Los Angeles to develop and support the ongoing education and development of its employees, while at the same time creating employment opportunities in the area.

In 2018, Grifols employees collectively received 2.5 million training hours. This represents an average of 137.7 hours per employee. Women received 65.9% of total training hours. In terms of areas of focus in 2018, the company concentrated its efforts on promoting Grifols' corporate culture, developing leadership competencies, and offering programs to reinforce its high standards of quality, safety and technical excellence.

Environmental management

Environmental management underpins the group's corporate responsibility. It is supported by the tenets of the Environmental Policy, approved by the company.

Grifols allocated significant investments in 2018 to improve its environmental performance and make further inroads toward meeting its 2017-2019 Environmental Program Policy objectives.

In 2018, the collective consumption and emissions from Grifols production plants in Spain, the United States and Ireland were as follows:

- Energy consumption:

- Electrical consumption: 384 million kWh

- Gas consumption: 418 million kWh

- Water consumption: 3,321,569 m3

- Total associated emissions: 295,924 T CO2E

In 2018, investments focused on reducing water consumption and emissions from refrigerant gases. Corporate investment in environmental assets reached EUR 2.7 million (EUR 8.5 million in 2017). Costs rose to EUR 15.5 million, compared to the EUR 13.6 million in 2017. The difference compared to previous years derives from a change in accounting criteria for this type of investments. In previous years, only the portion of the project carried out during the year was listed for accounting purposes, whereas as of 2018, the entire investment is recorded the year the project is finalized. The main environmental costs derived from waste management and wastewater treatment initiatives.

On the whole, including costs and investments, 63% of resources were allocated toward waste management; 32% related to managing the water cycle; and the remaining 5% were dedicate to reducing atmospheric emissions, energy and others.

Every year, Grifols takes part in the Carbon Disclosure Project (CDP), which evaluates the soundness of corporate strategies and performance with regard to climate change. In 2018, Grifols earned a "B management" rating, the same as the previous year.

1Underlying EBITDA excludes the impact derived from Haema and Biotest plasma third-party sales.

2Operating or constant currency (cc) excludes exchange rate variations of the year.

3It relates to the Hologic acquisition; the Aradigm assets reassessment; and the U.S. tax reform